Zü…Bas…Ber…Gene…Tici… – did I trigger you enough already? 🙂

Today we want to find out: which is the best Swiss Canton to live in? A question which can’t be answered easily and is definitely not straightforward. Try telling someone from Basel that Zürich is the best place to live, or try to convince someone from Swiss Romande that the other side of Röstigraben is way better. Having lived in different places in Switzerland, although all of them were in the German-speaking part of Switzerland, I got an idea about the prejudices and biases when it comes to the best place to live.

So, while I know that the title is catchy (and I hope I got your attention by now), we want to have a fact-based view about the topic. Of course everyone has their own preferences and criteria when choosing their best place to live. This post is meant to give an overview about the different Swiss cantons, looking primarily at the monetary aspects.

Target audience

My main focus for this article are expats, even though Swiss citizens can also learn a thing or two. If you live outside of Switzerland and consider moving here for work: this post is for you. Also, if you are an expat already living in Switzerland, you might find some useful information.

I’m an expat myself and I already lived in four different Swiss cantons, so I have some experience about this topic. Disclaimer: I’m a native German speaker, so for me it’s easy to understand Swiss people in the German-speaking parts of Switzerland. I’ll add some tips and tricks at the end of this article for non-German / non-French / non-Italian speaking expats, so stay tuned.

Introductory words

First of all: this post is going to be selective. I’m mainly focusing on the taxes and costs in the different Swiss cantons. As most of you know, you shouldn’t make a decision about where to live solely on the taxes alone. There are many more factors to consider when it comes to selecting a place to live. Language is one of the biggest factors, especially if you don’t speak any of the official Swiss languages German, French and Italian. (Yes, Rhaeto-Roman is the 4th official Swiss language, but I doubt that any expat speaks Rhaeto-Roman as his native language)

Switzerland is an attractive country for expats, due to its high standards of living, the very nice nature and of course the high salaries. End of December 2021, roughly 2.2 million foreigners lived permanently in Switzerland (Link to SEM – German). The percentage of expats with Swiss residency reached 25.7% in 2021 (Link to Statista – German). So 1 out of 4 residents in Switzerland is coming from abroad.

The largest group of expats is coming from Italy, followed by Germany, Portugal, France, Kosovo and Spain. For a more detailed list, you can check official numbers from the Federal Statistics Office here. Please note that the latest version is from 2020.

If you are a native English speaker and don’t speak German/French/Italian yet, most probably you’ll find it easier to move to a bigger city like Zurich, Geneva or Basel – instead of moving to canton Uri. Dear reader from Uri – please don’t curse me. I randomly chose Uri as an example, and I really like your canton. I’ve been to Seelisberg a lot of times already, and visiting Rütli-Wiese is very high on my bucket list.

Basis of calculation

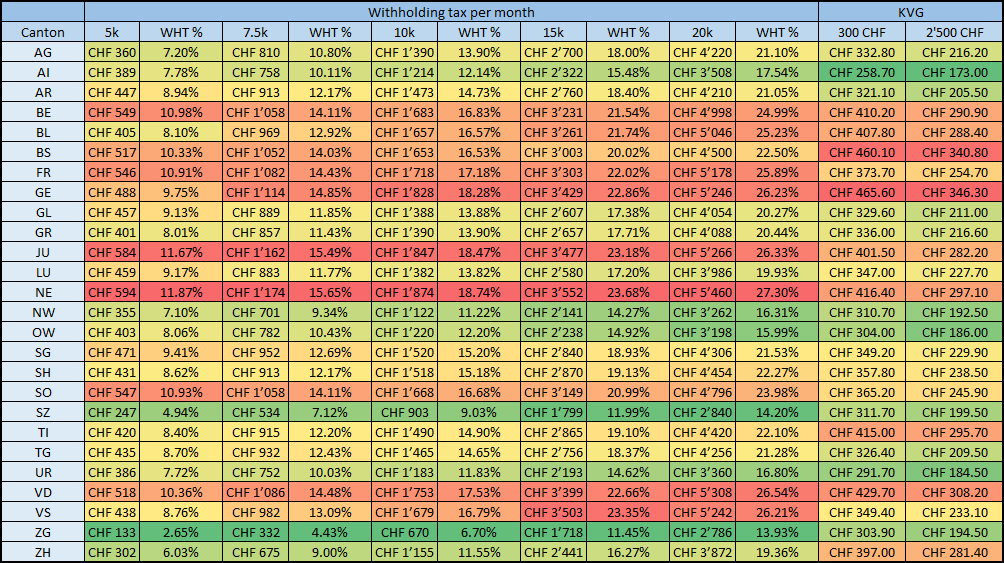

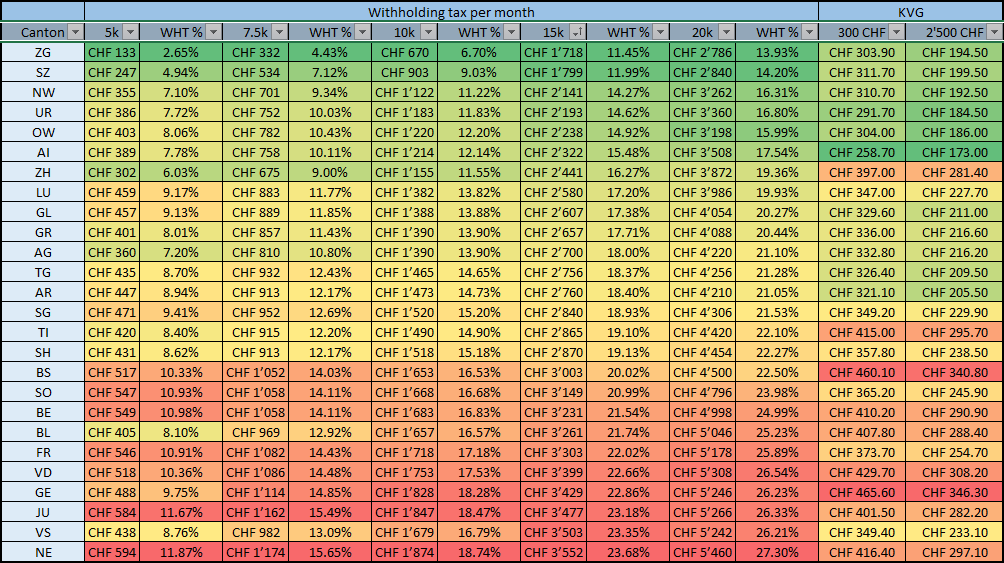

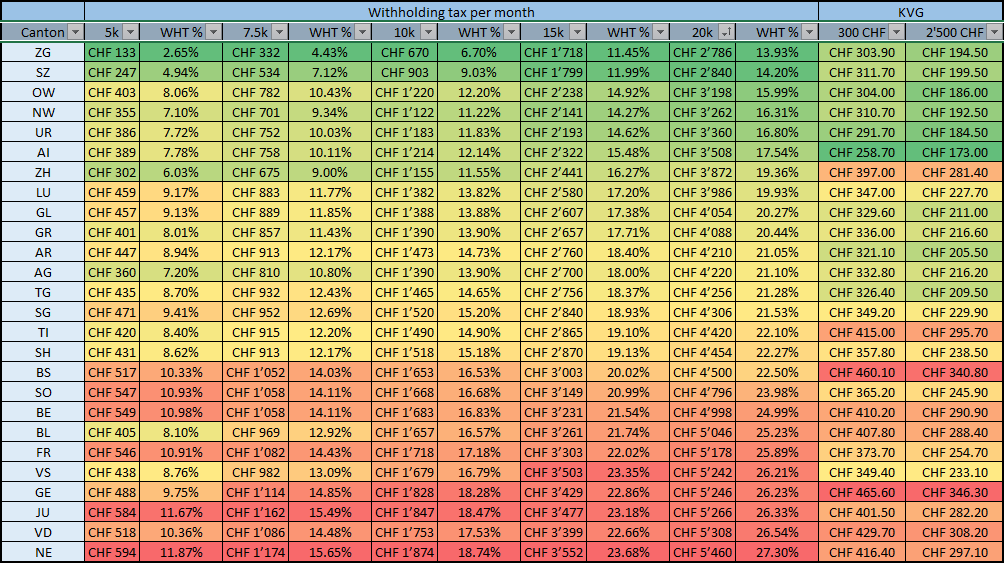

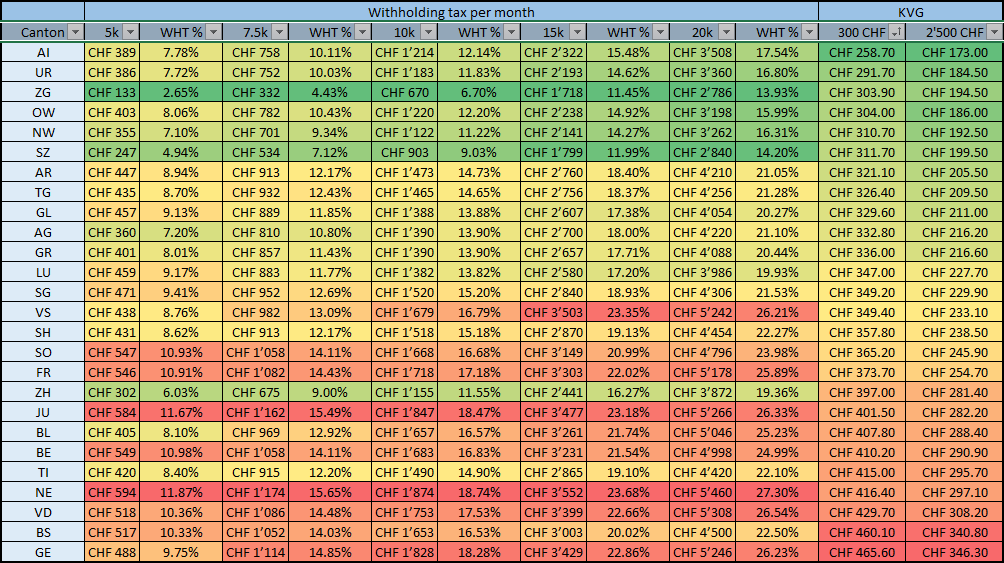

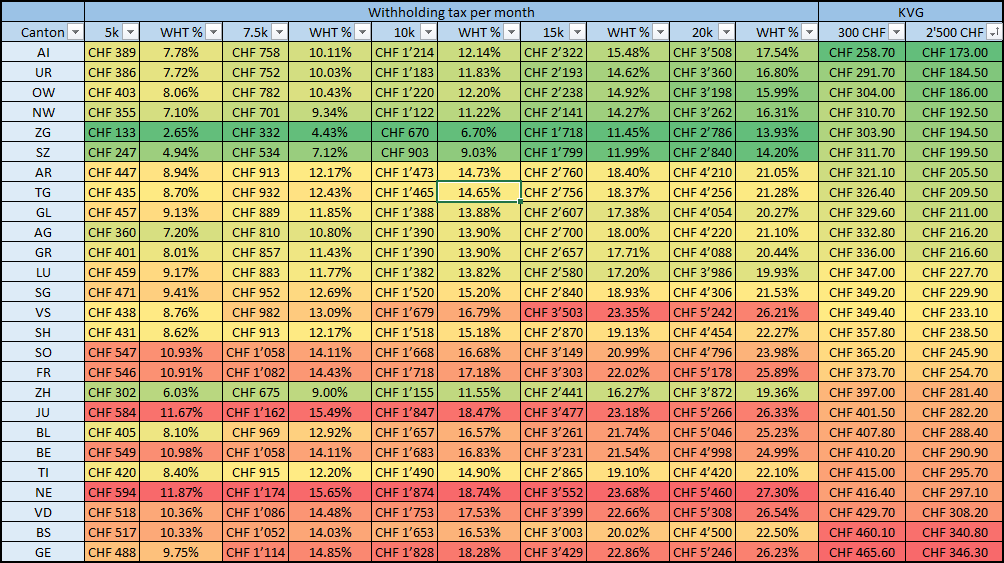

For the sake of simplicity, I chose to concentrate on a few main aspects. The main focus of the calculation is the amount of taxes and the premiums for the mandatory health insurance. Therefore, I downloaded the 2022 withholding tax rates for each canton, and compared the tax brackets for different incomes per month (CHF 5’000.-, CHF 7’500.-, CHF 10’000.-, CHF 15’000.-, CHF 20’000.-). To be more precise, I used the rates for a single person without kids and without confession (no church tax). Of course, the numbers will be different if you are married and have two kids. For Ticino and Vaud, I didn’t find the official tax rates on their website (I don’t speak Italian and hardly speak French – using Google Translate via Chrome didn’t help), so I used the withholding tax calculator from Comparis instead.

Using withholding tax is not 100% correct. If you earn more than CHF 120’000.- per year (or your net worth is higher than the cantonal threshold), you will not be taxed at source anymore, but you have to do a normal tax declaration (the same way a Swiss person has to declare them). Also, if you declare your taxes normal, your local taxes of your village (Gemeinde) have a bigger impact on the calculation. This is especially important for places like Zurich-City, where you will pay higher taxes when being taxed normally compared to paying withholding taxes. Therefore, I chose to use the withholding tax rates for each canton – to make the comparison easier.

For the mandatory health insurance, I used the health insurance calculator from comparis.ch. I know that Comparis might get commissions for advertising certain health insurances, but it was the easiest way to run the numbers. The numbers were calculated for a 30 year old person born on 01.01.1992 – and I selected both the highest (CHF 2’500.-) and lowest franchise (CHF 300.-) per month. I selected each cantonal capital to get the numbers for the premiums.

Show me the numbers!

Ok, enough of the bla bla. Without much further ado, here are the numbers:

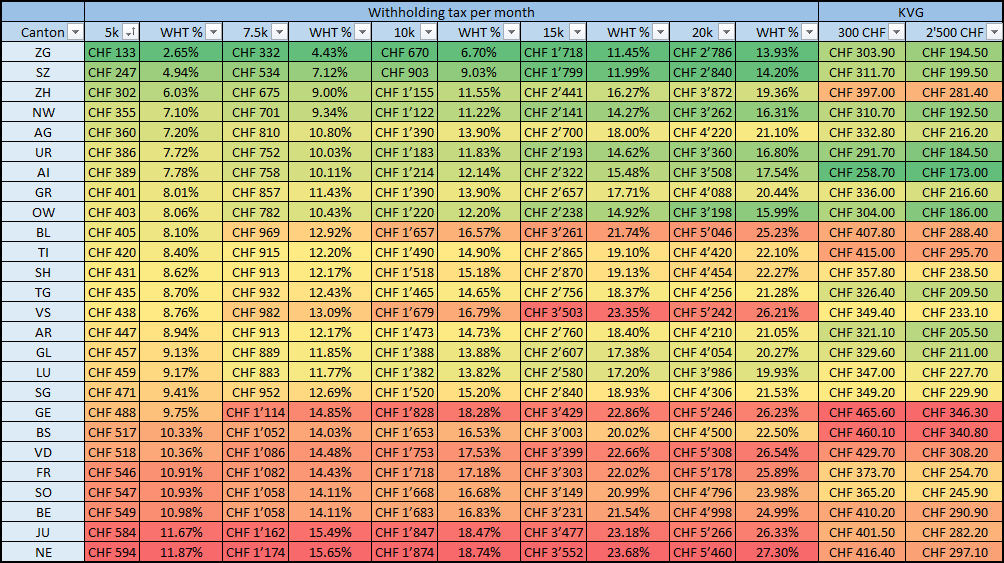

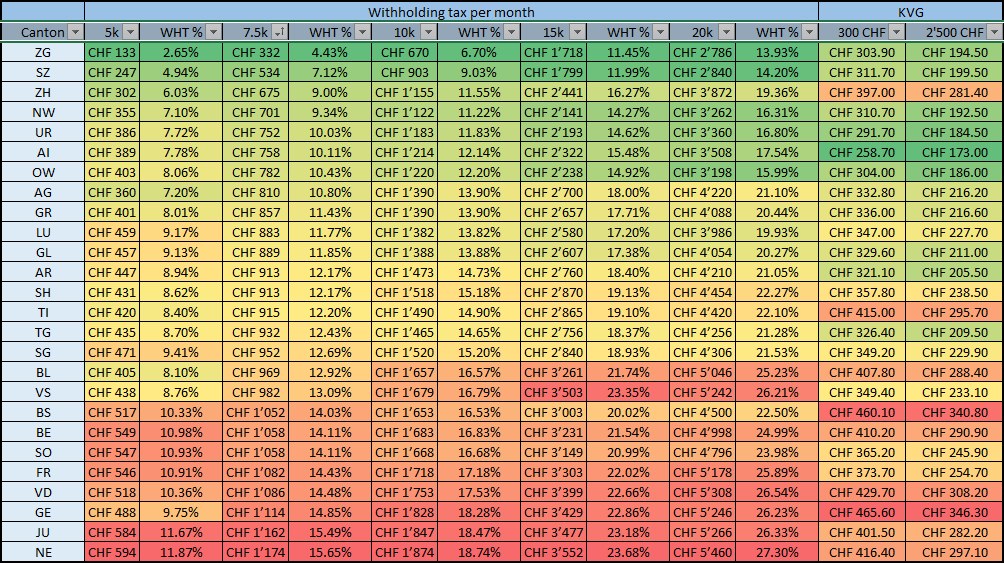

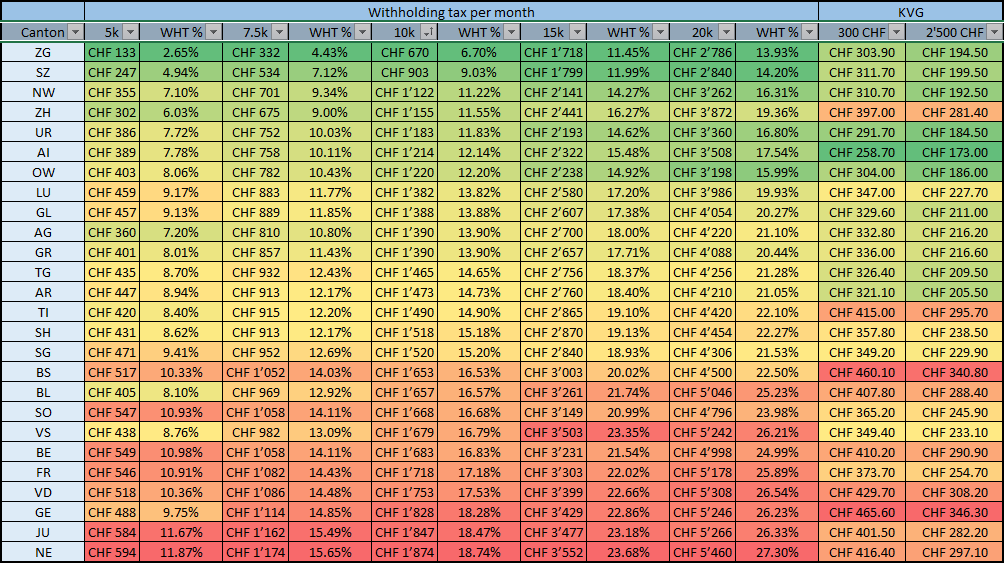

That’s a lot of numbers, isn’t it? To break them down a bit more, I filtered the lists.

CHF 5’000 per month

CHF 7’500 per month

CHF 10’000 per month

CHF 15’000 per month

CHF 20’000 per month

Health insurance – CHF 300.- franchise

Health insurance – CHF 2’500.- franchise

Findings

First of all: I’m happy that you are still here! Which means you haven’t stopped reading and didn’t leave already. If you don’t want to check all those numbers yourself, I got you covered.

What do we see in those tables? Cantons like Zug and Schwyz, who are famous for low taxes, have their reputation for a reason. Both cantons rank first and second for all salaries when it comes to low taxes, be it 5k per month or 20k per month. They also rank very high in terms of health insurance premiums.

On the opposite side, we have cantons like Neuchatel, Jura and Vaud. All those cantons are in the French-speaking part of Switzerland. In general, the French-speaking part of Switzerland has higher taxes and higher health insurance premiums than the rest of the country. Progression can be very different between the cantons, e.g. Basel-Land has a very steep progression when you earn a higher salary.

People in cantons like Appenzell-Innerrhoden, Uri and Obwalden seem to be quite healthy, while people in Geneva and Basel-Stadt have to pay very high health insurance premiums. I’m wondering if people in Basel have to cross-finance the big pharma companies? 😉

What do those numbers mean? If someone is earning CHF 10’000.- per month and he or she is able to chose her canton freely, this person can save much more in cantons like Zug or Schwyz compared to cantons like Neuchatel or Jura. Let’s compare Zug and Neuchatel: out of CHF 10’000.- gross, the person pays CHF 864.50 = CHF 670.- (withholding tax) + CHF 194.50 (health insurance – 2.5k franchise) in canton Zug. In Neuchatel, the person has to pay CHF 2’171.10= CHF 1’874.- (WHT) + CFH 297.10 (health insurance). Which is a difference of CHF 1’306.60.

If you multiply by 12, the person can save more than CHF 15’000.- in taxes and health insurance premiums just by living in canton Zug. What’s even worse? The difference in savings increase further if you earn higher salaries.

What is not covered (yet)

As you can see, I mainly focused on taxes and premiums for health insurance. Of course, those are only two variables when it comes to your savings rate. Things I did not yet account for: costs of rent (apartments in Zug are usually more expensive), average costs of real estate (in case you want to buy a property), no local village taxes (can be quite different in the same canton), costs for childcare, costs for your car (insurance premium and taxes), wealth tax etc. I intentionally left most of those things out, because the exercise would get a lot more complicated. Still, I might do another post on costs of housing, which is usually the biggest expense for most people.

Summary

As I already said before, doing a comparison for taxes and health insurance alone is not enough to select the best canton to live in. Other things to consider are: do I feel welcomed in my new canton? Do I speak the language? Are local people friendly to foreigners or not? Also, it heavily depends on your personal situation. You can’t live in Ticino, if your work is in Schaffhausen. Unless you are living in Schaffhausen during the week, but that’s another story.

There’s no “one-size-fits-all” answer to the question “which is the best Swiss canton?”. It’s highly subjective, and everyone has different preferences. Some people prefer to have city life, others are much happier when they have mountains and silent nature around them. For expats, especially English-speaking people, it’s often easier to move to a larger city where people are more likely to speak English as well. Additionally, the chance of finding other English-speaking expats is also higher. If you are a native German, French or Italian speaker, it’s usually easier to move to the corresponding German-, French- or Italian-speaking parts of Switzerland. But don’t take that as a general rule – I know German people who were really happy in Swiss Romande and enjoyed it much more than e.g. Zurich.

I hope you will find the numbers useful, and you can decide for yourself which Swiss canton is the best for you. Cantons like Zug are magnets for high-earners – and due to their international companies, also a lot of English-speaking expats chose Zug as their main residency. Some final point you should still consider: what’s the point in saving CHF 300.- on taxes if you don’t like your neighbors and you don’t feel welcomed?

A wise person should have money in their head, but not in their heart - Jonathan Swift